Billion Dollar Mind: There Are Three Levels Of Opportunity And Most People Are Stuck In Level One, But They Have No Idea

What You Unlock Today

Free Subscribers: The Constraint Solver System

Learn how to solve growth constraints without deploying capital—the same approach that helped one company avoid a $500K equipment purchase.

In today’s post, you get:

A Dallas HVAC case study - How one company captured $200,000 per year in overflow work they were turning away.

Three cross-industry examples - From radio advertising to motorcycle manufacturing to medical logistics. Each has unlucked hundreds of thousands of dollars with this approach. Proof this approach isn’t industry-specific—it’s adaptable to your business.

A framework for solving constraints creatively - See where you’re competing on table stakes versus creating real competitive advantage.

You’ll see whether you’re stuck at Level 1 (using platforms like everyone else), operating at Level 2 (structuring creative deals), or ready for Level 3 (monetizing what you built).

Paid Subscribers: The Complete Constraint Solver Prompt

Every business has one constraint that limits everything else. Most solve it by buying equipment, hiring staff, or building infrastructure.

What if there were five other ways to solve it that you’ve never even considered before?

This AI prompt finds them in 15 minutes.

What You Get:

The Solutions Everyone Else Misses - You identify your #1 constraint. The AI shows you competitor partnerships, technology shortcuts, and creative trades that work immediately and cost nothing.

Everything You Need to Execute - Who to contact. What to say. How to structure the deal. Week-by-week roadmap from stuck to revenue.

How to Monetize What You Built - Sell that solution to others facing the same problem. Turn your constraint fix into recurring revenue.

How This Article Fits Into The Full-Scale System That Builds On Itself Every Week

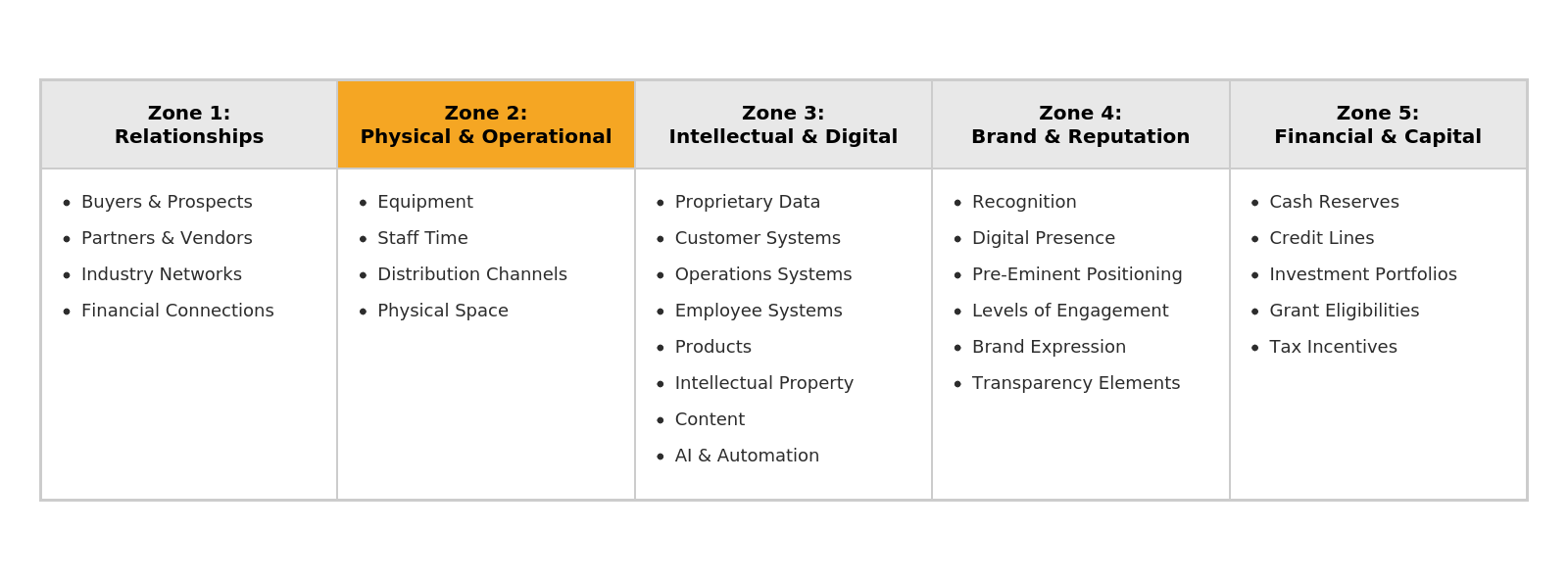

This week’s Constraint Solver System is Zone 2 of my Hidden Assets methodology—activating physical and operational capacity that sits idle in your business. The equipment, space, staff time, and trucks you’re already paying for but that generate zero revenue during downtime.

FULL ARTICLE

Nearly every business makes the same mistake:

They confuse ownership with control.

They think: “If we don’t own it, we can’t control it.”

And they’re burning millions as a result of the blindspot.

Here’s what I mean:

I had a Dallas HVAC client who was drowning in success.

Sounds like a good problem, right?

Not when you’re turning away $200,000 in overflow work every peak season because you’ve hit capacity.

They came to me with the obvious solution already mapped out: Buy more trucks. About $500K worth.

Here’s what made them hesitate though—and this is where most businesses get stuck. They wonder:

“What happens when peak season ends? What if demand drops next year? When those happen, I’ll be stuck with an expensive truck I’m not using.”

Valid concerns. But they were asking the wrong questions.

I’ve structured over 200 capacity-sharing deals across 40 industries, so I can spot this pattern in the first five minutes of a consulting call.

And here’s what I knew that they couldn’t see:

Most businesses don’t have capital problems. They have access problems:

When you need computing power, you don’t build a data center—you access AWS (Amazon Web Services).

When you need specialized software, you don’t hire developers—you subscribe to someone else’s software solution.

When you need inventory storage fulfillment, you don’t build warehouses—you use existing warehouses (eg, Amazon Fulfillment)

When you need distribution, you don’t build a delivery fleet—you use existing logistics networks like Amazon Logistics.

The asset you need already exists. Someone owns it, and it’s sitting idle much of the time. And the owner would rather generate revenue from it than watch it depreciate.

So I asked my Dallas HVAC client one question he’d never even considered:

“Where are the trucks you need right now?”

Blank stares.

The answer: Sitting in competitors’ parking lots, unused 40% of the time. These competitors were underperforming HVAC companies in the same market.

The competitor had the capacity. My client had the demand.

They structured a deal in 24 hours.

My client put their magnetic signs on those trucks. Their shirts on those technicians. Paid the partner company to handle overflow work.

$200,000 gained with zero capital investment.

They handled every job that season. Then the next. Then the next.

They structured what I call “Competitor Capacity Sharing.”

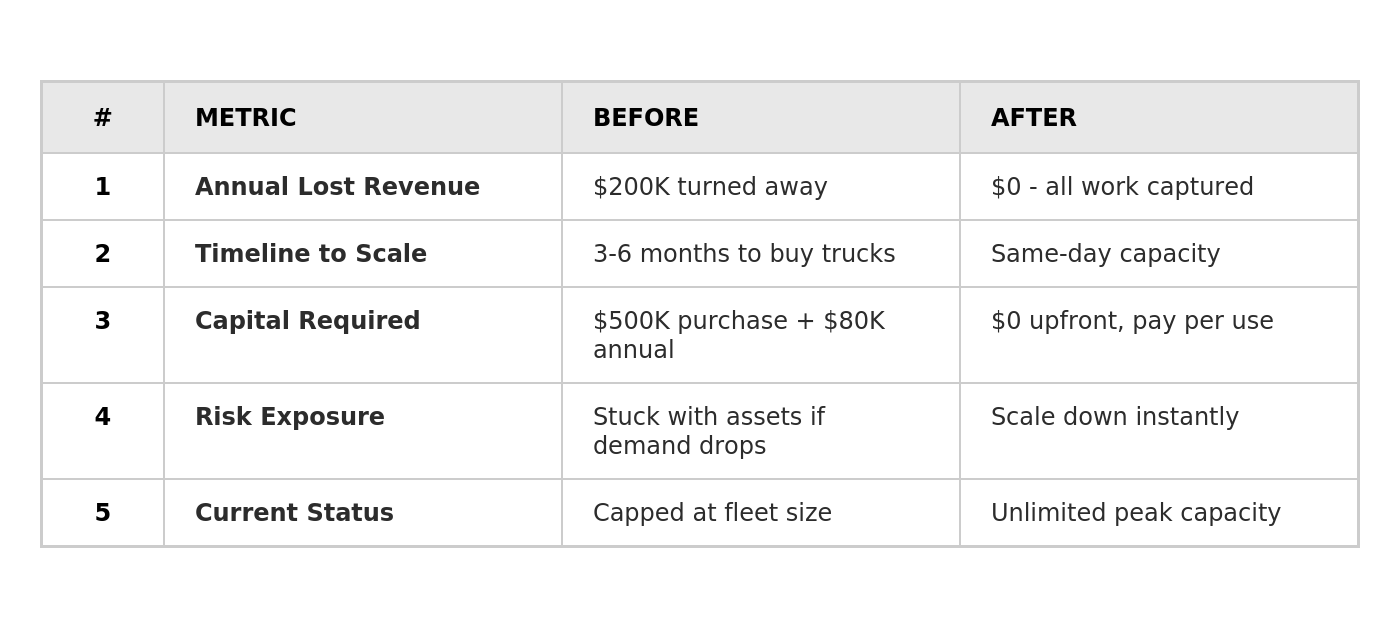

Here’s a before-and-after snapshot of how this one decision changed the game on five levels:

They’re still using this model today because the economics work, and the flexibility it provides protects them.

In summary:

The Dallas HVAC company thought they had a capacity problem. They actually had an access problem.

They believed: “To control our ability to serve peak demand, we need to own more trucks.”

That’s backward.

Control doesn’t require ownership. Control requires structured access to capacity that already exists.

The trucks were sitting in competitors’ parking lots. My client didn’t need to buy them. They needed to create the deal.

When I work with clients, I show them the five zones where hidden assets sit:

The Dallas HVAC company had a Zone 2 problem.

That’s the pattern I’ve seen across 400+ industries over 50 years: Most businesses don’t have capacity problems. They have access problems.

The trucks existed. The skilled technicians existed. The insurance and maintenance infrastructure existed. My client just needed to create the deal.

The Competitive Advantage Inversion

Here’s the shift I’ve seen over the last 30+ years–a shift that most businesses missed when it happened:

1990s-2000s: Competitive Advantage = Asset Ownership

Walmart won because they owned distribution centers

FedEx won because they owned planes

Hilton won because they owned hotels

Winners controlled physical infrastructure.

2000s-2010s: Competitive Advantage = Access

Netflix won by NOT owning servers (streams to 230M subscribers on AWS)

Instagram won by NOT owning infrastructure (sold for $1B with 13 employees, ran entirely on AWS)

Dropbox won by NOT owning data centers (built $10B company initially running on Amazon’s cloud)

Winners paid only for the capacity they used.

2010s-2025: Competitive Advantage = Connecting Unused Capacity To Demand

Amazon won by NOT owning inventory (marketplace model—sellers own their inventory)

Airbnb won by NOT owning hotels (17X more rooms than Hilton, owns zero properties)

Uber won by NOT owning cars (drivers own their vehicles)

Winners connected their customers to others’ unused capacity.

Bottom line: If you’re still trying to compete only on asset ownership, your business playbook is 30+ years out of date.

Why This Matters To You Right Now

While you were reading that story, you’ve probably identified 2-3 capacity constraints in your own business:

Maybe you’re turning away $50K-$300K in overflow work annually, because you don’t have the staff.

Or you’re about to spend $200K-$800K on equipment to solve a seasonal problem.

Or you’ve been stuck at current capacity for 18 months while competitors scale past you.

Every month you hesitate to apply the Constraint Solver System could cost you $15K-$50K or more in revenue. But you don’t have to waste another quarter capped at current capacity, or worse, another year watching competitors grab market share you can’t service.

The Dallas HVAC company solved its capacity problem in 24 hours with this model.

However, many operators outside the HVAC industry who hear this story say the same thing (and you might be thinking it right now):

“That’s HVAC. My business is different. This doesn’t apply to me.”

Wrong.

This wasn’t a clever tactic for one HVAC company. It was an example of a universal principle that you can use right now….

The Three Levels of Capacity Access (And Why Most Businesses Never See Level 2)

My Dallas HVAC client didn’t just access capacity that already existed on some platform. There was no Uber for HVAC trucks. No marketplace to rent competitors’ equipment.

They had to create the access solution.

And it’s the move I look for when working with clients—spotting where capacity exists but the access structure doesn’t.

Over 50 years of structuring these deals, I’ve seen three levels of capacity access.

LEVEL 1: CONSUME (What Everyone Knows)

Use platforms and services that already exist. As I mentioned earlier:

When you need computing power, you don’t build a data center—you use Amazon Web Services (AWS).

When you need specialized software, you don’t hire developers—you subscribe to Software as a Service (SaaS platforms).

When you need distribution, you don’t build a delivery fleet—you use Amazon Logistics.

Everyone does this. Your competitors access the same platforms you do.

This is better than defaulting to ownership—you’re asking what you need versus what you should buy. But it’s still basic-level thinking.

But what happens when no platform exists for what you need?

You’re stuck. No marketplace, no obvious solution—just the expensive choice between building it yourself or buying it outright.

Most businesses stop here. They think: “No platform? I guess I have to build it or buy it myself.”

That’s where Level 2 comes in.

LEVEL 2: CREATE (Where No Solution Exists)

When there’s no marketplace, no platform, no obvious solution—you don’t default to ownership. You create the access structure yourself.

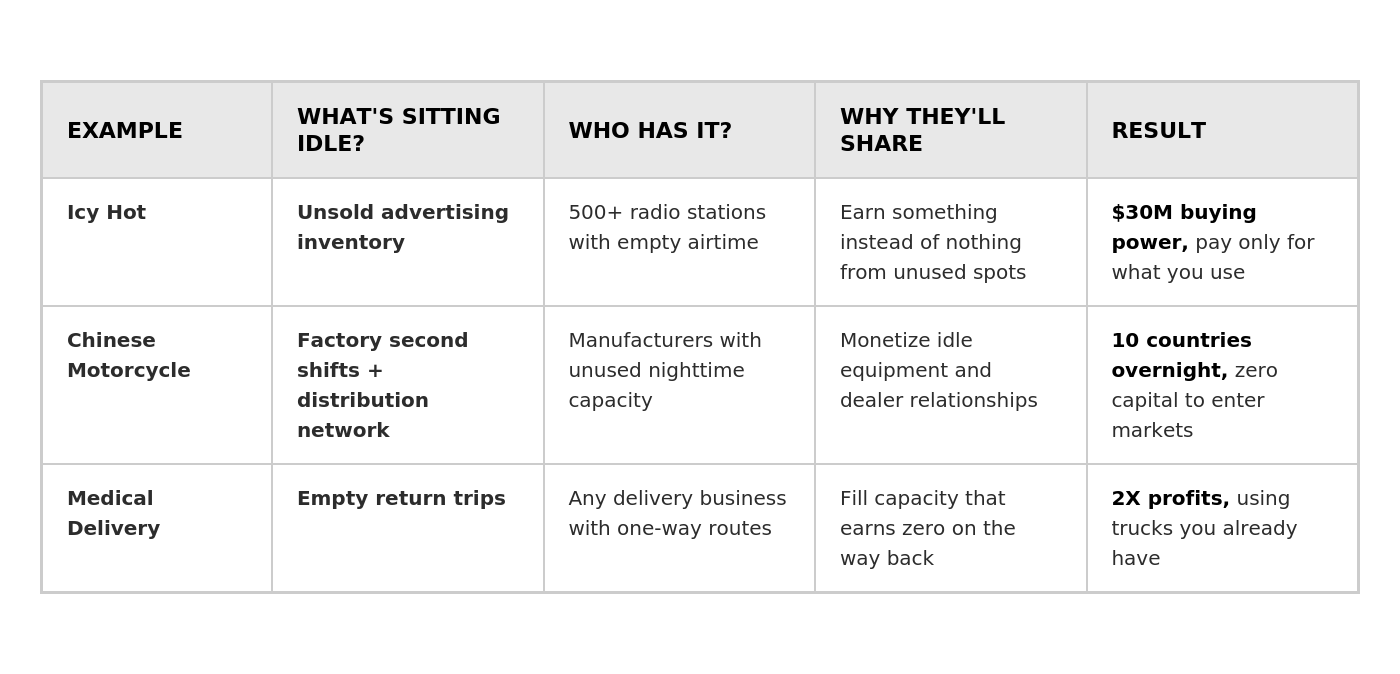

Watch it work in three industries that have nothing to do with HVAC:

Icy Hot Example (Cost Savings):

I identified 500+ radio stations with unsold airtime inventory. Radio stations preferred earning revenue from spots that would otherwise go unsold. I structured a bulk buying deal that gave Icy Hot $30M in annual radio buying power—paying only for spots they actually used.

Chinese Motorcycle Example (Market Access):

A small Chinese motorcycle manufacturer wanted Asian expansion but had no factory capacity or distribution. I found Malaysia’s largest lawnmower manufacturer with unused second-shift capacity and an existing dealer network across 10 countries. The lawnmower factory monetized that capacity. The motorcycle company got instant manufacturing and distribution. Both companies netted $20M in the first year with zero capital deployed. The motorcycle company entered 10 new markets overnight.

Medical Delivery Service Example (Revenue Generation):

Sam’s medical delivery company transported blood and organs to hospitals. Every truck returned empty. I helped Sam partner with a struggling package delivery service—Sam would handle their deliveries on return trips, eliminating their staff and processing costs in exchange for a revenue split. Sam doubled company profits in year one.

To summarize:

Every CREATE deal activates at least one of three partnership mechanisms:

Cost Savings: You solve the constraint for a fraction of the ownership cost. Icy Hot built $30M in radio buying power by accessing unused inventory across 500+ stations—paying only for spots used instead of retail rates.

Market Access: You gain instant entry to markets or customer segments. The Chinese motorcycle manufacturer accessed 10 countries overnight through the lawnmower factory’s existing dealer network across Asia.

Revenue Generation: You monetize idle capacity that was generating zero revenue. Sam’s medical delivery company doubled profits by filling empty return trips. The lawnmower factory earned $20M from nighttime capacity that previously sat dark.

LEVEL 3: LEVERAGE (Monetize What You Created)

Most businesses stop at Level 2. They create access, use it for themselves, and call it a day.

But here’s what they’re missing: Once you’ve created an access structure, you now own something valuable. You can sell access to your access.

Icy Hot Example:

Icy Hot (ya, these guys again) created $30M radio buying power for their own product.

A few years later, a major pharmaceutical company acquired the Icy Hot brand for $60 million. They only valued the retail business.

They let my team keep three “worthless” assets that we immediately monetized:

The network of 1,000+ media outlets

The direct sales distribution channel

The database of 500,000+ customers

We used these to sell other non-competing products. The pharmaceutical company paid $60 million, thinking they’d bought the business. They actually bought just the retail brand—while the real revenue-generating engines stayed with us.

That’s leveraging at the deal level. Here’s what it looks like at scale:

Amazon Example:

They built AWS infrastructure to run their own e-commerce platform. Then they sold access to that infrastructure to other companies.

AWS is now a $90 billion business—larger than their retail operation.

Here’s what this looks like in your business:

Scenario 1: You implement AI to handle your customer service emails—cutting response time from 4 hours to 15 minutes. Five businesses in your industry want the same setup. You charge $10,000 for implementation plus $500/month for maintenance. Your internal efficiency tool becomes a recurring revenue stream.

Scenario 2: You build a custom automation tool to handle your customer onboarding—saving 15 hours weekly. Three companies in your network ask to use it. You charge $500/month per company. What you built to solve your own problem now generates $18,000 annually in recurring revenue.

What started as solving your own constraint is now a revenue stream.

The Decision Framework That Changed

When you hit a capacity constraint, you face one decision: How do I solve this?

For 30 years, businesses asked: “Should I build or access this capacity?”

Now the question is: “Should I consume, create, or leverage?”

Consume means to use existing platforms. Create means build access where none exists. Leverage means monetize what you created.

Most businesses deploy capital to Level 1 thinking—using platforms everyone else uses, then wondering why they’re not differentiated.

The businesses winning right now:

Consume efficiently (access rather than own)

Create custom access structures for themselves (this is where they pull ahead of competitors)

Leverage what they built into new revenue streams (turn one solution into multiple income sources)

You just learned to see all three levels.

Here’s how to apply this to your business right now.

How To Complete The Constraint Solver Analysis In 10 Minutes Instead Of Six Months

The Dallas HVAC company had me across the table, showing them the $200K in overflow work. You need to find those opportunities yourself.

Working through this manually could take months or longer. You’d need to calculate true ownership costs, identify potential partners, and build evaluation criteria from scratch. Most businesses spend six months analyzing and miss their revenue window entirely.

Here’s what we’ve built for you:

An AI prompt that delivers your complete build-vs-access analysis in 10-15 minutes. Not generic advice—a consultative conversation about YOUR specific situation that walks you through the entire framework.

What you walk away with:

1. 5-6 Creative Solution Paths You Haven’t Considered

Your constraint analyzed across six solution categories. Each path shows a specific approach, timeline, estimated cost vs. buying, and trade-offs.

2. Clear Cost Comparison for Your Specific Constraint

See exactly what each solution path costs versus buying or building. One path might cost $0 and deploy in 24 hours. Another might cost $5K and take 2 weeks. Buying might cost $500K and take 6 months.

3. Partner-Finding System (if you choose the ACCESS path)

Where to find partners with unused capacity, a five-criteria evaluation scorecard to rank prospects, three proven deal structures, and word-for-word approach scripts. Find and close partnerships in one week instead of six months of dead ends.

4. 30-Day Implementation Roadmap

Week-by-week action steps for your chosen solution path. Know exactly what to do week 1, week 2, week 3, and week 4 to solve your constraint without deploying capital.

5. Your Leverage Strategy

Once you’ve implemented your solution, here’s how to monetize it: TEACH it (workshops/courses), LICENSE it (recurring revenue), or BROKER it (sell access to your network). Expected value and timeline for each.

The difference: Manual analysis takes months. This prompt takes 10-15 minutes.

Without this analysis, you’re risking $250K-$500K in capital deployed to the wrong solution. With it, you can save that same capital that you almost spent, and deploy it to your actual competitive advantage instead.

Here’s How To Use It

Step 1: Open Your AI Tool

You need an AI that can think through your business systematically. Three options:

Claude.ai: Use Claude Sonnet 4.5 or higher

ChatGPT: Use ChatGPT 5 and toggle “Thinking” mode ON (upper left corner)

Jay-I Super Clone: Your 24/7 strategic thinking partner encoded with 50+ years of my proven methodologies (paid subscribers get 25 free credits/month)

Step 2: Copy And Paste The Prompt

The prompt is designed to do all the heavy lifting—no preparation needed.

Scroll down to find your prompt

Click anywhere inside it, press Ctrl+A (Windows) or Cmd+A (Mac) to select all

Press Ctrl+C (Windows) or Cmd+C (Mac) to copy

Press Ctrl+V (Windows) or Cmd+V (Mac) to paste

Hit Enter or click Send

Step 3: Have the Conversation

The AI will immediately start asking you diagnostic questions. Just answer naturally as if talking to a consultant.

Get the Most From Jay-I Super Clone

While the universal prompt works in any AI tool, Jay-I is specifically trained on my 40+ years of consulting across 1,000+ industries. In fact, it includes hundreds of millions of words from all of my classes, coaching calls (anonymized), books, and articles that I’ve ever written. It thinks like I think, asks what I’d ask, and spots opportunities the way I spot them.

As a paid subscriber, you get 25 free credits monthly—enough to run multiple strategic diagnostics.

Below is The Constraint Solver prompt designed to translate insight into immediate action.

Let’s begin.

Jay Abraham

Michael Simmons

Max Bernstein

Keep reading with a 7-day free trial

Subscribe to jAI to keep reading this post and get 7 days of free access to the full post archives.